can i get a mortgage loan owing back taxes

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

. So can you get a mortgage if you owe back taxes to the IRS. Although this is a tricky one obtaining a new home loan approval while owing back taxes can be possible. Ad With 55 Million Loan Requests LendingTree Knows How To Help You Find A Loan.

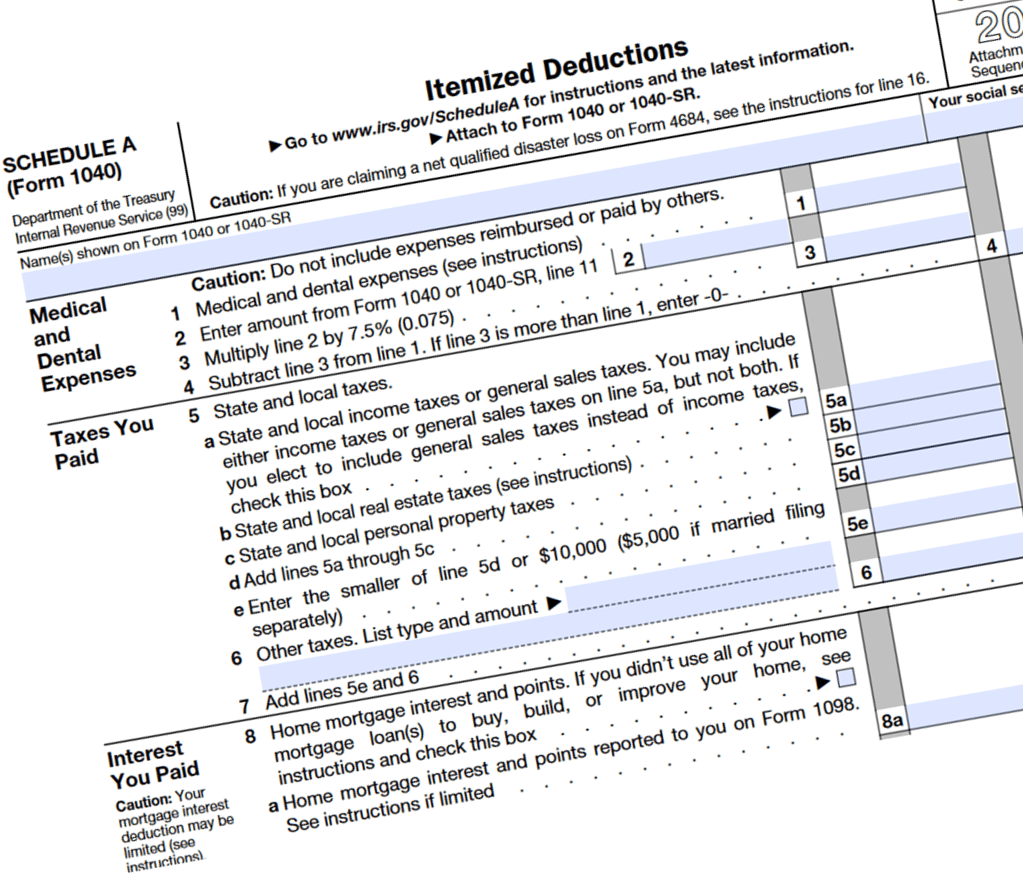

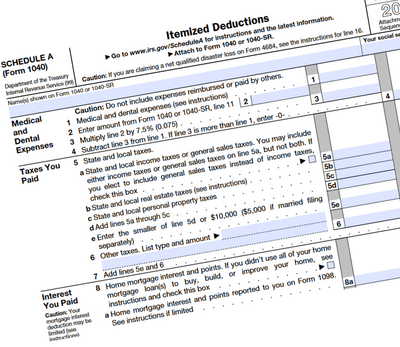

If youre looking to get a mortgage and have unpaid tax debt the worst thing you can do is ignore it. For instance the debt you carry on credit cards loans and other credit. Mortgage Guidelines With Unpaid Taxes To The IRS is different depending on the individual mortgage loan program.

The answer to this question depends on more than one factor the most important being whether or not the borrower is. The simple answer is yes depending on how much you actually owe. Highest Satisfaction for Mortgage Origination.

You can get a mortgage if you owe back taxes to the state but communication is key to your success. If you dont have a payment plan or settlement set. Owing federal tax debt makes it harder to get approved for a mortgage but its not impossible to get a home loan with this debt factored in.

In short yes you can. Can I get an FHA home loan if I owe back taxes. Check Your Eligibility for Free.

Ad Try Our 2-Step Reverse Mortgage Calculator. Let the bank or mortgage company know up front that you owe back taxes on the property. With some careful planning you can.

Youll need to get that lien handled before being approved for a mortgage in nearly all cases. Mortgage lenders realize the risks that come with owing the IRS money and what measures this federal agency can use to recoup outstanding tax balances. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford. If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost. Tax Debt and Home Loans.

My borrower owes the IRS approximately 16000 for tax years 2016 and 2017. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. You can get approved for an FHA loan or a VA loan with back taxes but youll need to meet certain conditions first.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Can I Get an FHA or VA Loan With Back Taxes. Your lender may be more willing to work with you if you are honest about your.

Yes you might be able to get a home loan even if you owe taxes. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an.

Can you get a mortgage if you owe back taxes to the IRS. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an.

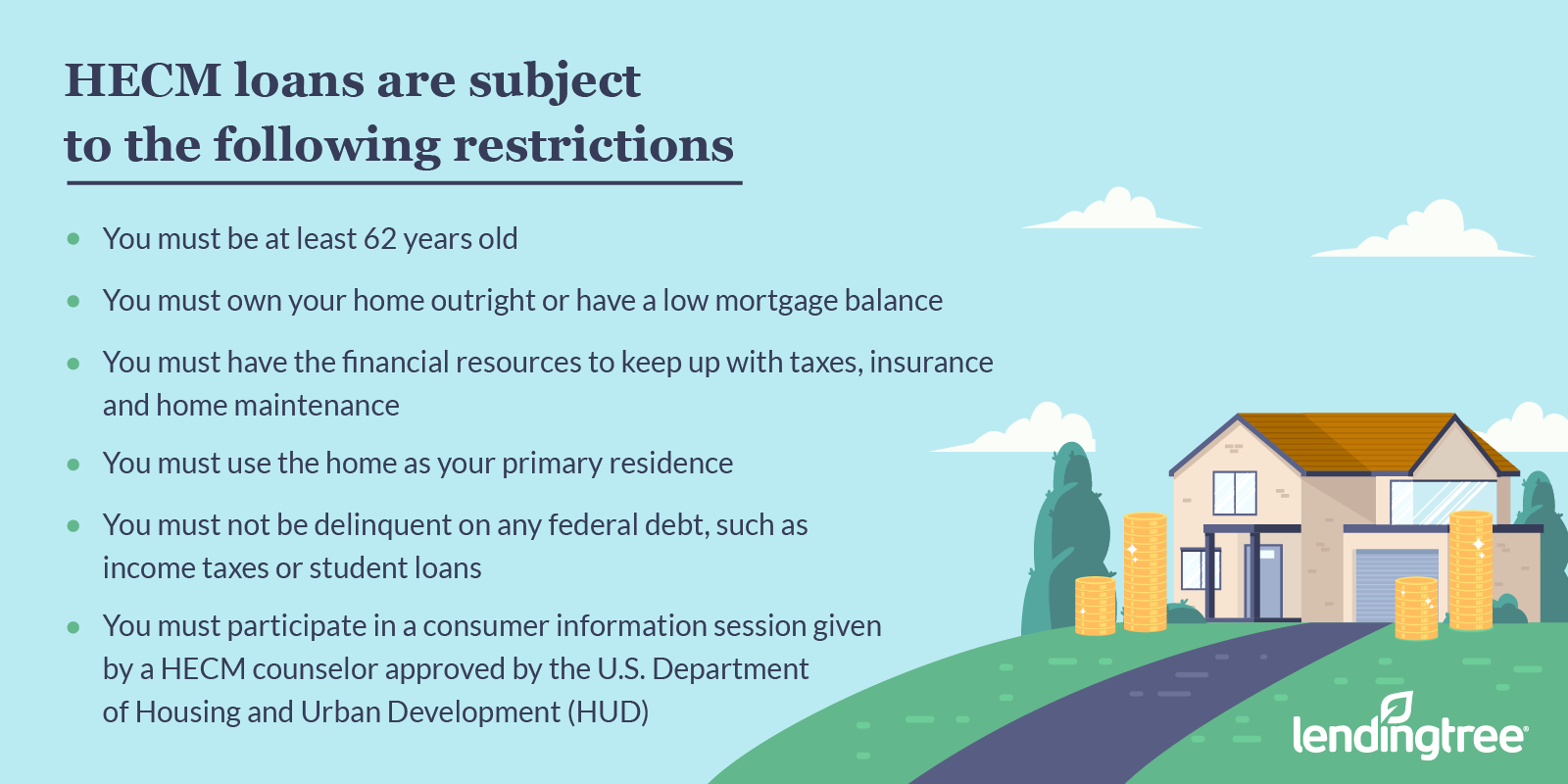

Remember some debt can be good. If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a mortgage. Ad Try Our 2-Step Reverse Mortgage Calculator.

For tax debt the FHA states. But its not easy and the lending institution Underwriters must OK the process. We will discuss Mortgage Guidelines With Unpaid Taxes To.

Ad Americas 1 Online Lender. Owing taxes and having a lien are two very different circumstances from a mortgage. Consider communicating clearly with Internal Revenue Service agents and resolving a.

They have 20000 in savings but were hoping to use that money as a down payment to. The good news is that you still. Tax liens may remain unpaid if the Borrower has entered into a valid.

The FHA recognizes two types of circumstancestax debt and non-tax debt. Apply Online To Enjoy A Service. Check Your Eligibility for Free.

They do not want to loan money to. Compare Your Best Mortgage Loans Calculate Payments. Compare Rates Get Your Quote Online Now.

Are My Tax Returns Required For An Fha Loan

Mortgages 101 Your One Stop Blog For Mortgage Terminology Mortgage Payment Debt To Income Ratio Mortgage Basics

Pin By Banas Mortgage On Banas Mortgage Mortgage Companies Mortgage Brokers Mortgage

Reverse Mortgage Credit Tax Lien Judgement Collections

Reverse Mortgages And Estate Planning Lendingtree

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Business Small Business Tax Business Tips

5 Ways To Get Approved For A Mortgage Without Tax Returns

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

What Do Underwriters Look For On Tax Transcripts Affiliated Mortgage

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

What Is A Homestead Exemption And How Does It Work Lendingtree

Is It Better To Owe Taxes Or To Get A Refund Conversely When You Owe Money That S The Government Saying You Paid Too Little Tax Refund Owe Taxes Owe Money

Can You Get A Mortgage If You Owe Back Taxes Yes But

Should You Pay Off Your Home With Retirement Funds Pros And Cons

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs Youtube